Artificial intelligence is changing the game. Software can now write, paint, and work thousands of times faster than the average person, and at human-indistinguishable quality - but most people have yet to fully process that impact.

That represents an opportunity. Big businesses and regulatory agencies are going to take years to figure this out, and you can take advantage of the gap in the market to both improve your business, make more money, and make your life easier.

In this series (which I'm also turning into a newsletter), the goal is to jam-pack every volume with simple, real ways to apply AI to various industries. I include examples, and show you specific steps that you can take to multiply your effectiveness. I also take industry requests.

So, without further fluff: let's get into some AI business ideas.

Artificial intelligence in banking

The banking industry is rife with opportunities to employ modern artificial intelligence. At present, legacy systems are archaic, inefficient, and often require significant turnaround times (like ACH transfers) that simply no longer need to apply.

Here are some ways you can use artificial intelligence in banking, whether you're a teller, administrator, programmer, mortgage underwriter, or executive:

1. Eliminate 80% of simple, redundant queries with an (actually good) AI chatbot

A massive point of inefficiency with our increasingly-online banking system is what happens when a customer requires additional help. Naturally, you turn to either in-person or phone banking.

If in-person, you need to physically displace yourself, perhaps taking an hour or more, just to wait in line and speak with a teller or representative that solves your problem using the same system that you already attempted to do so with.

If over the phone, then you often have to wait on-hold for an hour or more, for a representative somewhere in a less industrialized nation to discuss - at a very affordable rate, by the way - how to solve your problem. And that works to varying degrees.

Don't get me wrong: some of these questions do require human assistance. I would estimate around 20%. However, the bigger bulk of these queries are simple enough that a custom text generation algorithm trained on common queries could respond in a customized, realistic manner with success rates above 90%.

Stuff like "how do I do [insert simple online task here]?" or "why is my balance showing x?" is all very simple, and using flexible artificial intelligence rather than the strict, procedural chatbots that most of these banks are currently employing is so trivial that I'm aghast most companies haven't already done it. It's probably the lowest hanging fruit when using artificial intelligence in banking.

This would provide:

- A degree of customization likely to improve customer satisfaction scores,

- The ability to flexibly respond to questions that are, perhaps, not phrased in an effective way or that contain an abundance of spelling/grammar mistakes

This would be very simple to do: fine-tune a custom model using functionality that's already offered by companies like AI21Labs or OpenAI, and send all queries that are currently being used by the procedural chatbot to these AI APIs instead. To train, you'd prepare a list of a few common questions and answers in JSON format (which would take perhaps a few hours for even the most humble of administrative assistants).

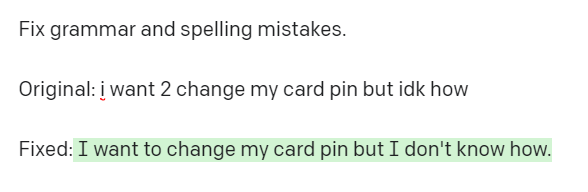

To improve the quality of this approach further, you could pass incoming queries through a natural language "correction" prompt, something like this:

Then, take the result (I want to change my card pin but I don't know how) and feed it to your custom model. I think a developer could probably integrate something like this in a couple of hours.

2. Personalized promotional bank outreach

Nothing grinds my gears more than a templated, mass-sent email or physical letter from my bank. They clearly try to make it emotionally salient, using words like 'valued customer', 'loyal client', and I have to give them credit - they do indeed insert my name at the beginnings of any communication ("Greetings, Nick!").

But this could be done so much better. Just off the top of my head:

- Get tellers, loan advisors, or mortgage specialists to write one sentence of personal, important information in a 'relationship' field on whatever archaic banking system you're using.

- Example: likes football, made a joke about Vancouver weather, worried about son's marriage. Anything short, offhand, or significant will do.

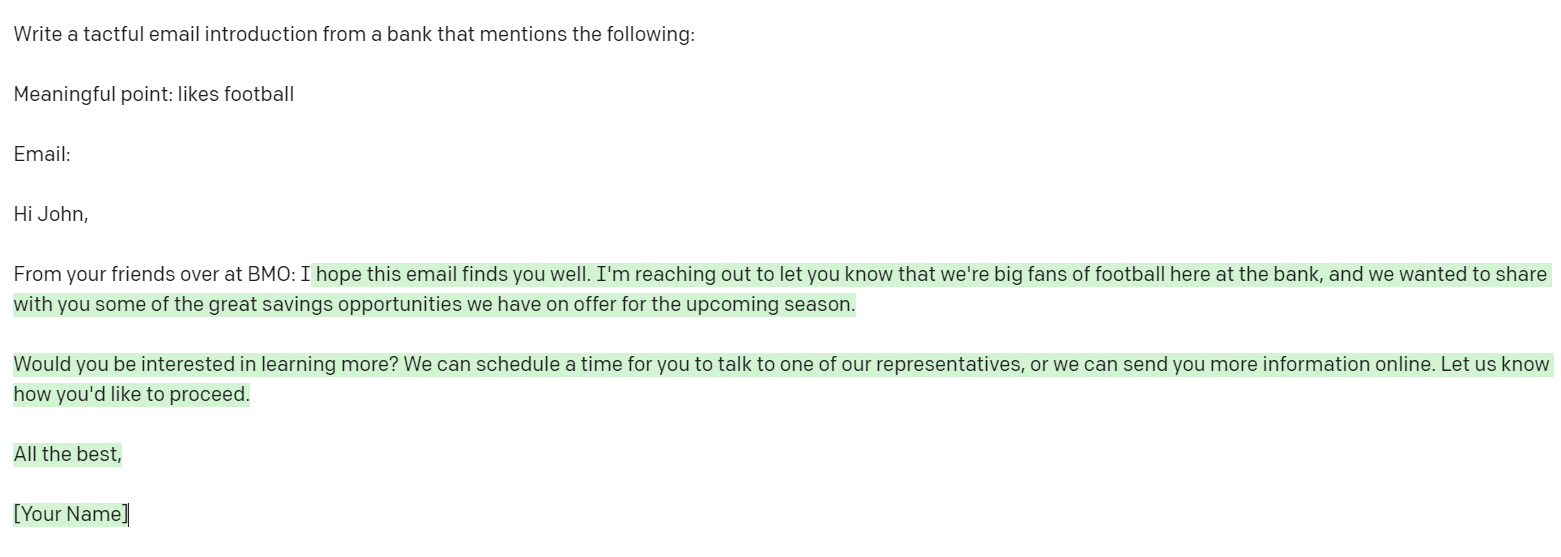

- Then, pipe the results through an AI text generation API with a prompt like the following:

- Sure, it's not perfect - and you can do plenty of prompt engineering to make it better - but the addition of a personal sentence that reminds them of a real-life connection already puts it a cut above. It's a surefire, simple way to use artificial intelligence in banking.

You can obviously do this for dozens of different industries, by the way - email is undoubtedly going to be a big chunk of this and future newsletters.

3. Simplify banking security questions with AI

What's your mother's maiden name? Which street did you grow up on?

If you don't remember literally every letter - punctuation, capitalization, and grammatical inconsistencies included - you're not seeing your money until next week.

Such approaches are obviously inflexible and in need of improving, especially considering how much manpower and customer-service support-hours are tied up in solving problems of this nature. I'd estimate security questions make up at least 10% of all customer service queries (happy to be corrected by a banking executive if wrong).

Here's how you'd use AI for it:

- Keep the questions, of course. Store their results in a database as you've been doing.

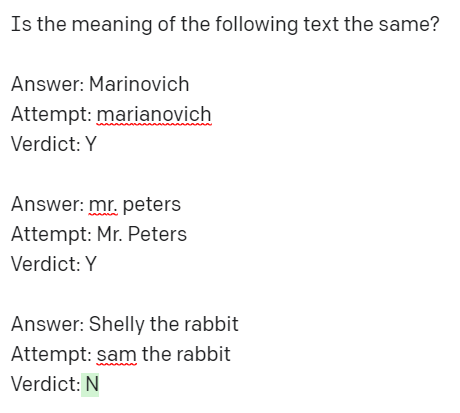

- The next time identity verification is required (i.e where these questions are normally asked), pass the customer's input through a 'normalization' prompt. Such a prompt would look something like this

- Of course, you'd train a custom model on perhaps a hundred instances of normalization rather than just the two I supplied above. The purpose here would be to capture the 'meaning' of the answer supplied, rather than exact-match it at every character.

- Now you have a flexible system instantly capable of handling a significant portion of security question customer support requests: misspellings or grammatical errors.

Note: this would, naturally, increase the number of successful fraud attempts. It's simply what happens when you make any security procedure more lax.

However, banks are capitalists. Perhaps the best capitalists. They can easily make the following cost/benefit decision: does the financial benefit of 10% fewer customer service requests outweigh the slight increase in fraud cases per week? My personal take would be yes (but again, I'd be interested in hearing a banker's perspective as well).

AI in banking: conclusion

There are hundreds of ways one can use artificial intelligence in banking.

Indeed, big banks already employ a fair amount of machine learning; they use well-vetted algorithms to verify card transactions, for example, and employ statistics to model investment performance.

But in 2022, we have even more technology available in our toolkit. Using the flexible NLP methods I described above, a bank can easily save 10% or more, practically instantly, on their marketing and customer support.

To summarize, those three methods were:

Enjoyed learning about how to use AI in banking? Want to learn how to apply AI in your industry? I publish posts like this once per week (or more) to my subscribers, and it's completely free. No spam.