As the size and scope of modern artificial intelligence continues to grow, so too does its potential impact on the insurance industry. In particular, AI will have a profound effect on claims processing – an area of the business that is ripe for disruption.

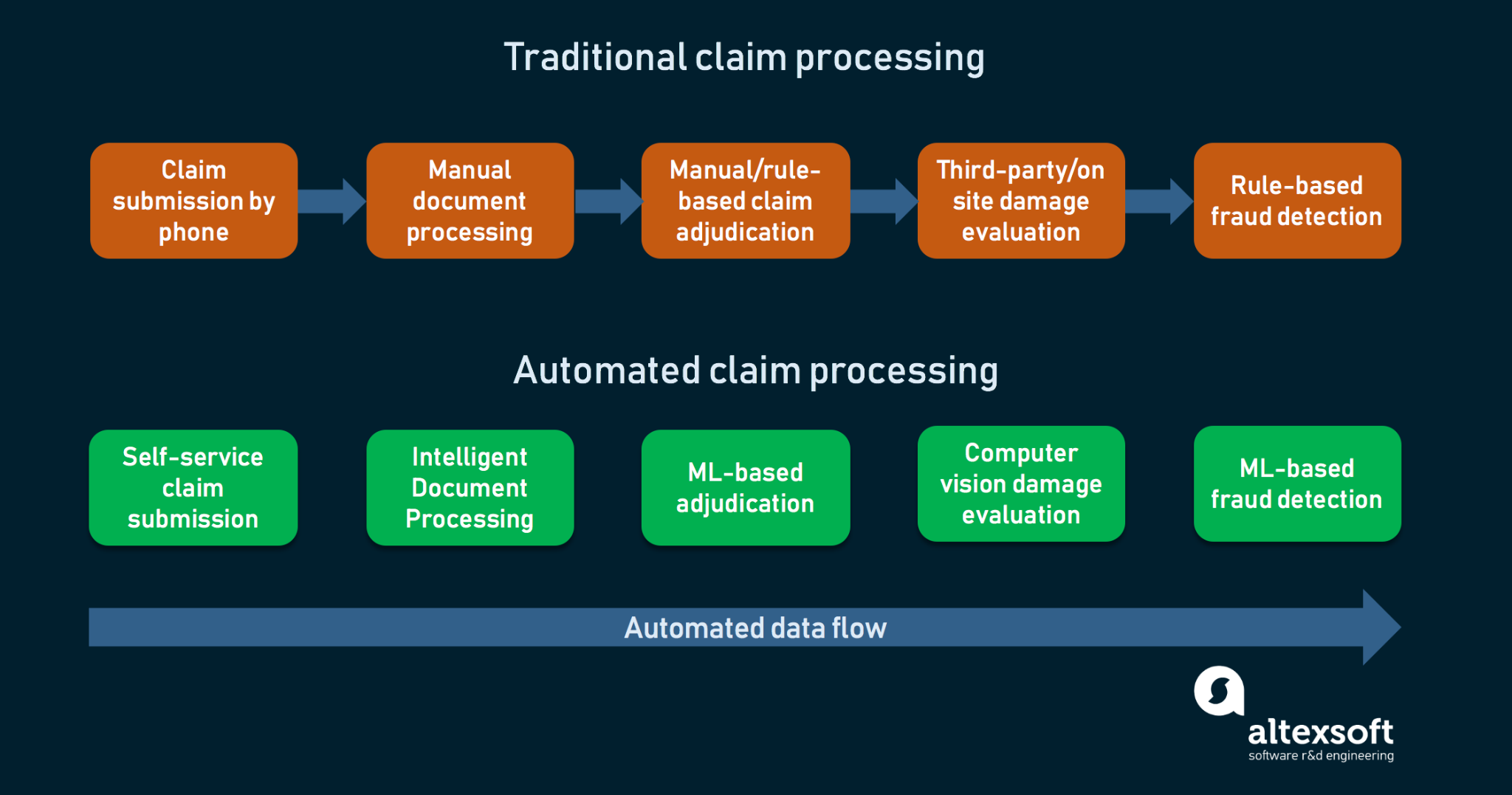

Though many companies attempt to optimize it, the bulk of claims processing is still done manually. This is time-consuming and often results in errors. It’s also expensive: the cost of processing a single claim can range up to several hundred dollars worth of human labor.

Flexible artificial intelligence can change that. By automating the processing of straightforward claims, it can free up time for human adjusters to focus on more complex ones. It can also help to identify and prevent fraud. And because it never gets tired or makes mistakes, it can do all of this at a fraction of the cost.

But how does it work? Below, we'll take a look at how artificial intelligence can be used to streamline claims processing.

Optimizing triage with AI

The first step in any claim is triage, where the adjuster determines the severity of the claim and decides how to proceed. This is often done with the help of software that sorts and filters claims based on certain criteria.

Current software, however, is static and inflexible. It relies on rules that are written by human beings and which can only be changed slowly and with great difficulty. This means that it’s often not very good at dealing with the complexities of real-life claims.

Artificial intelligence, on the other hand, is very good at dealing with complexity. Using machine learning, it can automatically identify patterns in data that human beings would never be able to see. This means that it can be used to develop far more sophisticated and effective triage systems.

Automating simple claims

Once a claim has been triaged, the next step is usually to gather more information about it. This is often done through phone calls or by sending out forms for the claimant to fill in.

This process is ripe for automation. Using natural language processing, artificial intelligence can understand the information contained in phone calls and forms. It can then use this information to populate the relevant fields in a claims management system.

One might imagine how an insurance company could automatically back up call recordings and then analyze them with the help of speech processing AI, creating transcripts that are later processed using an API like OpenAI or AI21Labs, for instance.

From there, advanced natural language algorithms could parse the text, understanding the customer’s sentiment, and extracting key information such as:

- The type of claim

- The severity of the incident

- Whether the claimant is likely to be cooperative

- And so on.

This would all happen automatically and in real-time, allowing adjusters to focus on more complex cases. It would also allow them to intervene if they believe that the artificial intelligence system is not correctly understanding a particular claim.

Reducing fraud with AI

Fraud is a major problem for the insurance industry, costing companies billions of dollars every year. Though there are many different types of fraud, one of the most common is “friendly fraud”, where people make false claims or exaggerate the extent of their injuries.

Artificial intelligence can help to reduce friendly fraud by automatically verifying claims. For example, it could compare the details of a car accident against police reports or footage from security cameras. It could also use facial recognition to verify that the person making the claim is who they say they are, through the use of simple web applications that run on open standards.

The future of claims processing

As AI continues to evolve, we're likely to see even more artificial intelligence claims processing in the future. We might soon use, for example, virtual reality to help assess damage after an accident. We might also see AI systems that proactively contact claimants to offer them assistance and support.

Whatever form it takes, one thing is certain: artificial intelligence is going to have a big impact on claims processing in the years to come. The companies that embrace it will be the ones that reap the rewards and slingshot ahead of their competition.